Dying too Soon?

Why

Dying too soon can leave a family/ business partner in a precarious situation, especially if the person was a key income earner. Life insurance is a simple low cost way to protect against this. When you deal with an insurance broker you can be assured you have the best coverage at the best price.

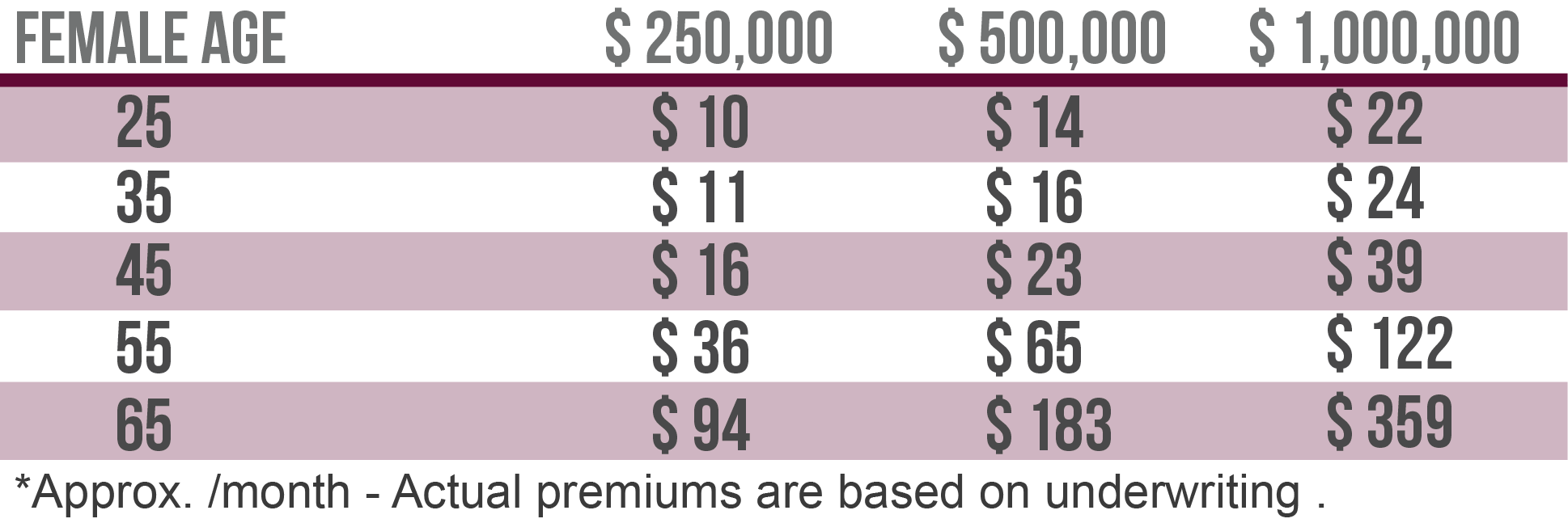

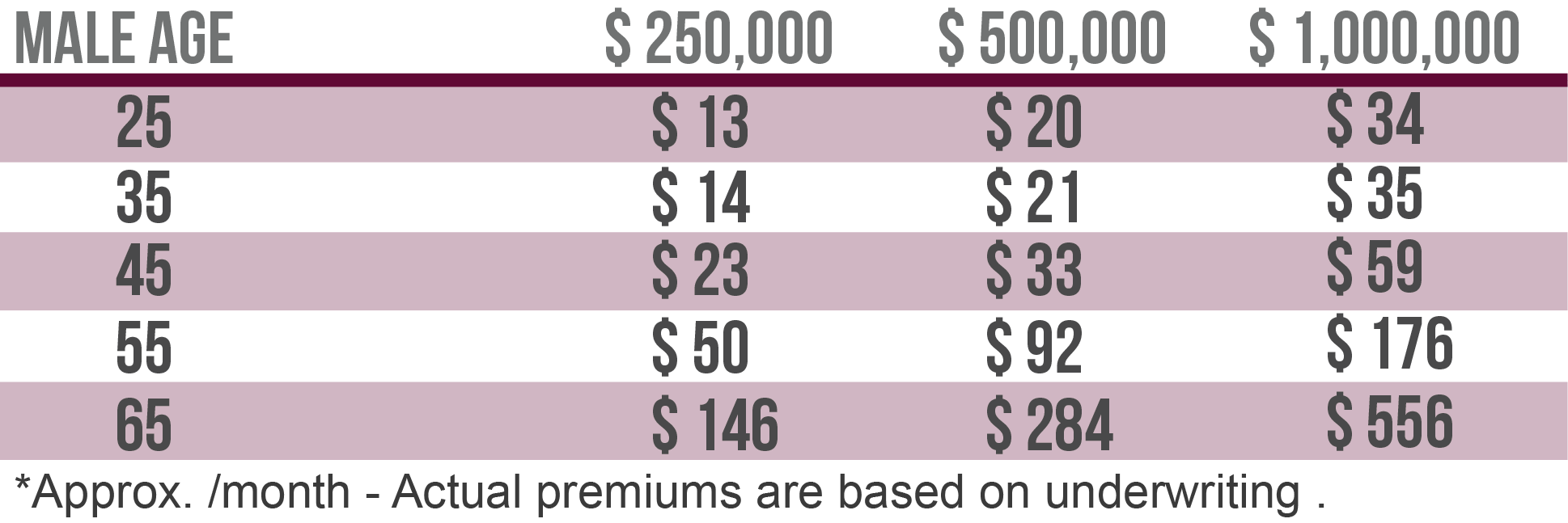

Below is a chart with some typical Term Insurance premiums:

How this works with your larger financial plan & goals

Life is a journey and we all go through many different stages. Over time our priorities shift and change. My job as an advisor is to balance your priorities and try to protect against the unknown.

The First key aspect to help maintain a balanced financial plan is to protect against Dying too soon. This can devastate a family or business and their financial situation. Life insurance helps to bridge the gap and ease the transition. When others depend on you for their financial well being life insurance plays a key role in protecting your family or business.

In summary it is important that we consider all aspects and we welcome the opportunity to review YOUR current plan. Knowing you have your ‘angles covered’ allows you to focus on living your life.